We are in the “not-enough” zone now…Brace for the impact.

It's been a while since we last conversed about the health of the auto sector (looking at the July-21 sales numbers) and highlighting the industry's pain points. The chip shortage, which many Indian industrialists also highlighted, has caused huge bottlenecks with backlogs near 500,000 units in the passenger vehicle segment (Maruti Suzuki has orders pending for ~210,000 units alone). The chip shortage caused by the supply bottlenecks has created another crisis in the world's fifth-largest auto market, which was already bleeding even before the pandemic. Couldn't help but think about a theory that I have read in Economics.

Reliance on few critical suppliers in the chain

There is a concept in Economics, which is termed "The Comparative Advantage," for example, if YOU produce a commodity in a more efficient way than ME, then you should produce that commodity (no offense to all the economists out there if the explanation’s not good enough). The world was already aware that CHINA produces things better than the others, but now it has led to over-reliance on CHINA for critical materials, which is now breaking even the most efficient of supply chains.

The shortage is everywhere

A week before, there was a breaking story covering the energy crisis in the land of China, where the shortage of coal led to production halts across industries, including some of the critical material makers over which the world is dependant. Is another sector lined for the impact due to this over-reliance?

The story has spread across the world, and we can also see some of the relatable aspects in our country. India's reliance on coal is close to 70% of the total electricity production, and it is a clear representation of the "not-enoughness" problem. The below tweet covers it well.

So, the point is, why has China been able to emerge as that dude on which the whole class is dependent for their exams? We'll get there.

Businesses are great machines, but these machines require a constant flow of capital (inputs) to produce and sell (output), and the managers (operators) try continuously to attract this capital at the lowest cost possible, which increases the value of the company (efficiency or throughput of the machine). One such input source is the DEBT, which some of us try to avoid due to its obligatory nature, but businesses that are confident enough about their profitability prospects can easily use it to their advantage while increasing the shareholder's value.

Pecking Order Theory

Confidence is the key, which drives the management's choices, but in turn, it gives a signal to the market participants, who view the use of DEBT as a signal that the management is confident that the use of debt would bring value to the organization, i.e., the project's prospects where the debt would be used is likely to realize profits which would be greater than the cost of the debt. Hence, the management now takes one step ahead and starts using debt even if they don't believe in the prospects.

Another advantage of using debt (already highlighted above) is the increase in the company's value as the overall cost of capital reduces due to the lower-than-equity cost of debt. Still, in the way, the company starts ignoring the debt ceiling.

Growth at all cost

China has been able to grow at a phenomenal rate in the past decade or so due to the government's strategy of "growth at all cost," which led to many businesses run for debt which allowed them to grow and expand their portfolio, giving them the power to have "Comparative Advantage" over other nations. The use of debt cannot be ignored in the case of China, and the Chinese companies (CSI 300 in the chart below) are one of the most leveraged out there. CSI 300, which is a major market index of China, has seen marginally decreasing leverage in the past five years, and the ratio was ~2.12x in 2017, which has reduced to ~1.83x. The Total Debt/ Equity is still one of the highest amongst other nations.

China's strategy of "growth at all cost" has allowed companies to become so big that they have eventually become a target in the eyes of the Chinese government. The government backed these companies and supported them to grow as long they shared their interests, but they faced the dragon's wrath as they tried to move away from China's control.

Evergrande, which is currently in the limelight, has grown with the help of cheap debt, which allowed it to develop more and more properties that created a vicious circle of more debt and more real estate properties. Currently, the company has ~$300bn in Total Liabilities, out of which ~$88bn is the debt. The default spooked the market, and trading was suspended for this particular company along with other prominent real estate developers in China as contagion risk started to haunt the market participants. Another real estate developer defaulted on its debt repayments scheduled on October 4, 2021.

The growth in the real estate sector in China fell to ~2.5% YoY (vs. expected at 7% YoY) in August-21 with the rising alarms and reduction in consumer spending in the economy, while the YTD growth was at par with the consensus. During the boom phase, companies try to outperform their peers by taking additional risks, which leads to excessive debt. This greed works in favour until the economy can't absorb it anymore and stalls eventually before creating a bubble.

Status of India Inc.

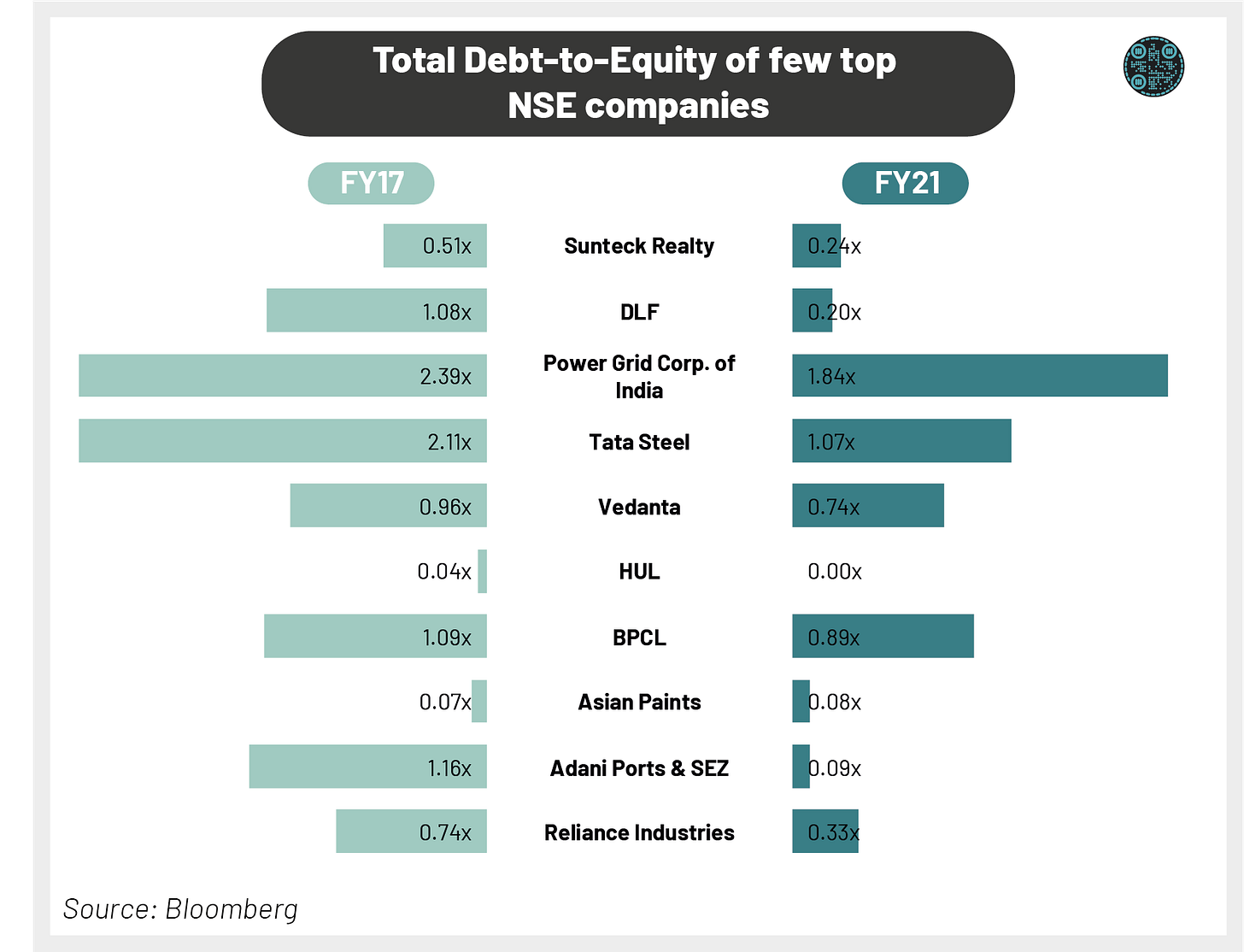

According to an article by Business Standard, India Inc. has witnessed a significant change in terms of Balance Sheet structure by the first decline in corporate borrowings in nearly two decades as the fresh issue of borrowings fell short of the repayments done by the corporates. As per the article, the Gross Debt/ Equity for the sampled non-financial companies fell to an 11-year low at 0.75x, while the Net Debt/ Equity to a 10-year low at 0.44x in FY21. Here's how the top companies of India Inc. fared during this test.

The analysis represents that the de-leveraged has taken place in reality, as seen from these top companies' declining Total Debt/ Equity. BS also reported that the decline was prominent in the case of commodity producers, which witnessed a sharp recovery, and hence, higher realizations such as in the steel sector where the steel prices went up by as high as 200% in the past 1-1.5 years. Still, some companies have reported an increase in borrowings in FY21, such as Tata Motors, Adani Green Energy, Bharti Airtel, etc.

So what changed in the recent years and why we see a contradicting story where on the one end of the spectrum is China, which can get over with its love for high debt, and on the other hand is India, where we can see corporate de-leveraging. My sudden reaction goes to the impact of a new set of shareholders that have started taking their investments seriously.

Shareholder activism in India

Debt is a two-edged sword, which, when used effectively, ensures shareholder's satisfaction but, on the other hand, increases shareholder's wealth destruction, which when used ineffectively. Not just because of debt but the way the management runs a company has caught the attention of shareholders. In the recent past, we have seen increasing cases of shareholder activism, with the recent one being one of the most dramatic, Invesco-Zee saga. Other cases of such activism being:

Eicher Motor's shareholders rejected the reappointment of the MD, Siddhartha Lal, over a proposal of increasing his remuneration, but the board later resolved the case.

One of the most known ethical firms, Infosys, has also been a target of such activism during the late 2016s when the founders criticized the remuneration system to the departing executives. It eventually led to the resignation of then-CEO Vishal Sikka.

etc...

One such other proxy which represents the status of Corporate Governance is the reported cases of whistle-blowing. As per one article by Economic Times, the number of companies disclosing these complaints increased in FY21, turning almost half of the NIFTY 50 companies compliant. Although the cumulative complaints disclosed by the 24 compliant companies of NIFTY 50 decreased in FY21, the cases registered by some prestigious companies such as TCS, Hero MotoCorp, etc., increased. The article pointed to an interview by one of the gentlemen at EY, the reduction in these cases could be attributed to a decline in interactions and the WFH setup.

The impact of the pandemic has changed the business dynamics significantly. According to a survey conducted by Deloitte Touche Tohmatsu India LLP (DTTILP), in association with the Institute of Directors (IOD), 62.89% of the Independent Directors felt that the current business disruption could spur fraud over the next two years, out of which ~22% would be due to large-scale remote working arrangements and ~20% due to limited communication with employees on prevention of fraud, misconduct, and non-compliance.

Ending remarks from your Helper

Although we have been one of the stakeholders, somehow, it would be interesting to see how it all pans out with the disruption in the economy. Firstly, there was the pandemic, which caused the demand to take a hit. Now there is excess demand, which can't be catered to immediately due to supply chain disruptions. Companies are getting hit from both sides, where some of the leveraged ones are going under and some experiencing cash crunch (which is reported by the survey talked above to cause 20% of the potential frauds in India over the next two years.)

Again...Brace for the impact

Disclaimer: The content published is only for educational purposes and not any kind of investment advice..

Author(s): Akshit Agrawal

We hope you liked this article, see you again sometime soon. Until then, you can share this post with others who might enjoy reading this..

Amazing

Superb content. 👍