The first week of August-21 is coming to an end, and automobile players in India have reported their sales numbers for the month of July-21. Let’s decode this, Shall we?

Some of the top players in their respective segments reported their July-21 numbers, and it pretty much clears what the conditions are in our country with respect to the Auto sector.

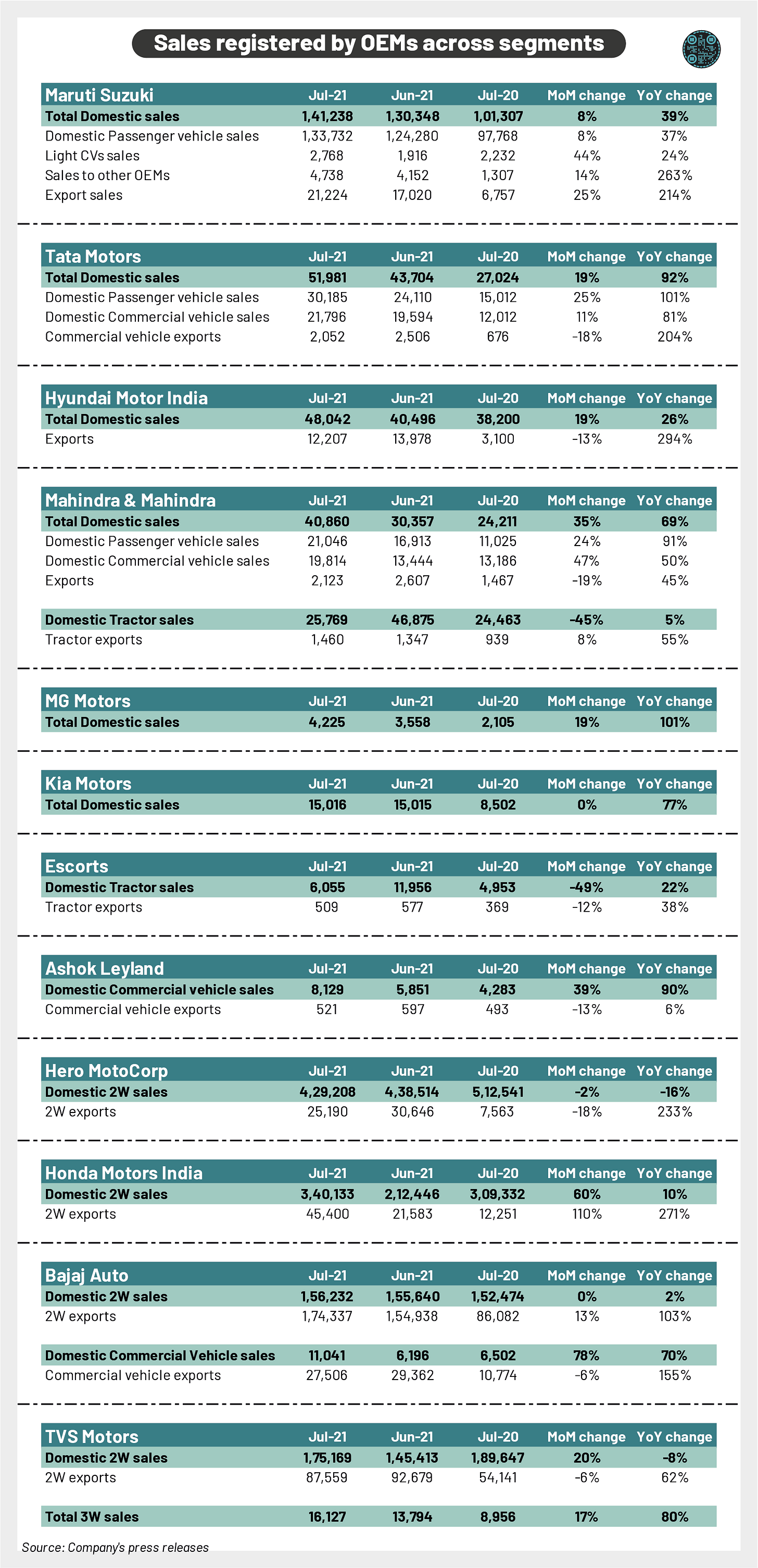

🚗 Passenger vehicle sales have been gradually moving to an upcycle fuelled by the strong demand across segments, with the overall passenger vehicle industry sales in India growing by ~40% YoY and ~16% MoM showing recovery compared to the restrictions due to the second wave and the initial lockdown period. Some manufacturers have reported a growth of >100%, such as Tata Motors and MG Motors, compared to the same month previous year. Growth in the adoption of EVs can be seen from the increased sales of carmakers in the segment such as MG Motors, Hyundai, Tata Motors, etc.

Various supply-side trends have impacted the margins of the carmakers as steel prices in the recent quarter, and it can be seen that several carmakers have raised their prices too to pass on the impact of higher raw materials.

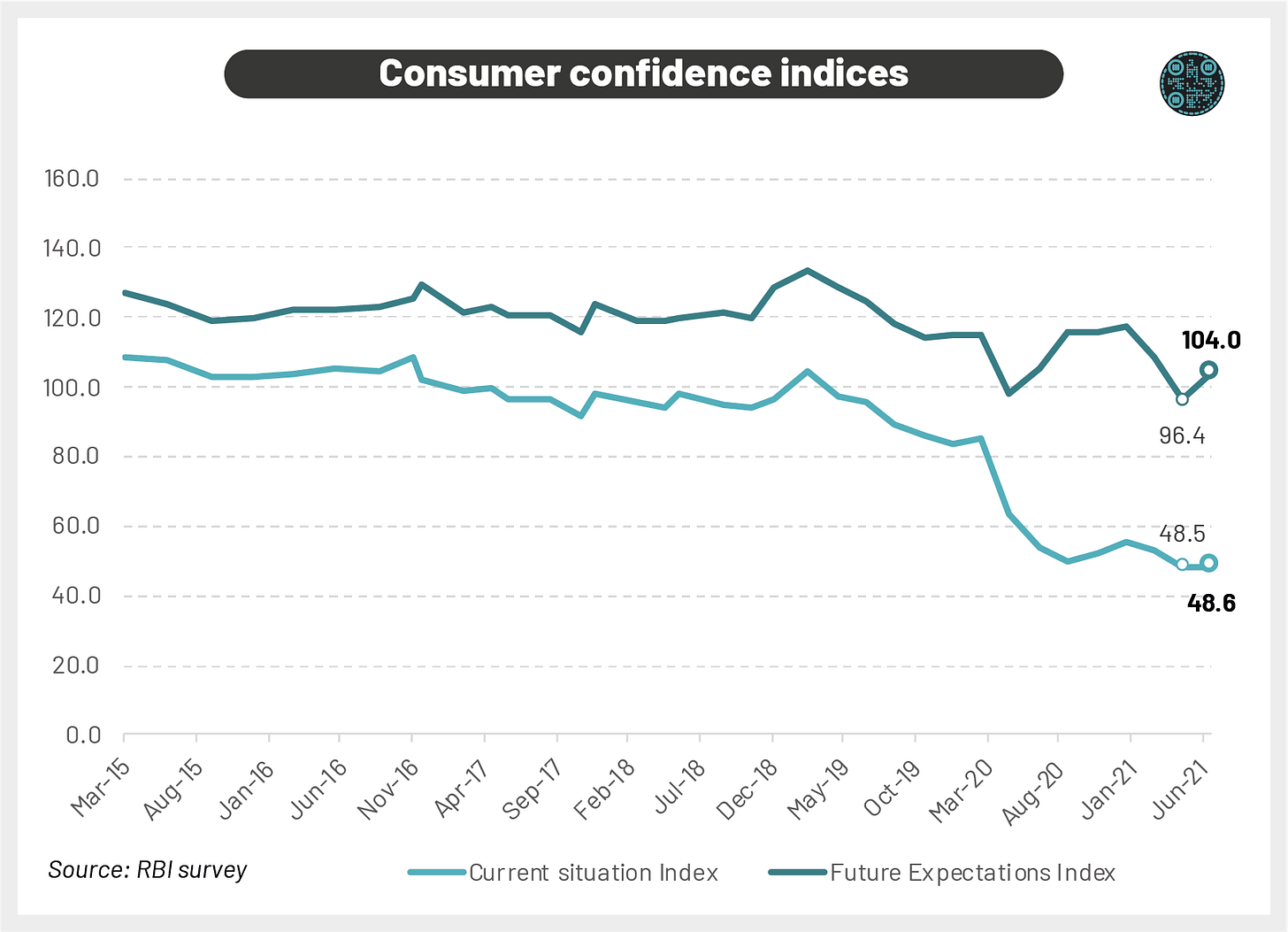

Talking about the demand side, fuel prices, the primary component, has increased significantly compared to the previous year. Petrol prices have increased ~25% YoY, while diesel prices have increased by ~12% YoY. These fuel hikes seem insignificant for the buyers as the growth in retail sales can be seen positively. Another metric that can be tracked down to these growing sales might be the increase in consumer's confidence with future expectations regarding their Income levels and overall spending environment. In July-21, the future expectations index moved into the optimistic territory, driven by the improvement in the situation after the waning of the second wave.

🏍 Regarding the other segments, 2-wheelers have also fared well, but the sales have increased only marginally compared to the previous year's figure. This was due to higher inventory levels at the dealerships, resulting in lower manufacturers' dispatches. The new registrations have increased YoY, which signifies growth in purchases compared to the previous year. The wholesale volume increased by ~17% MoM in July-21, reflecting the consumer's confidence concerning their future incomes. Some manufacturers have reported exceptionally healthy numbers in July 2021, such as Activa's manufacturer Honda which reported a ~60% increase in wholesale volumes compared to the previous month.

The demand side is heavily affected by the fuel prices as the users of these vehicles are sensitive to the costs associated with these segments. Also, with the transition to BS-VI engine norms, there has been a price hike of ~10% across companies seen by a significant increase in price realizations by the manufacturers. Hence, the cost of acquisition has increased, which might signify the lower demand altogether in FY21. The overall domestic 2W industry has been contracting for the past two fiscals by ~18% and ~13% in FY20 and FY21, respectively. The domestic manufacturers have not performed well in the export part, too, as the 2W exports also contracted in FY21, led by disruptions in the supply chain and other deteriorating trends due to the second wave.

Going forward, the rural sector growth led by healthy expected monsoon would drive the growth in 2W led by higher expected volumes in the Motorcycle division.

🚜 Other segments such as Tractors and 3-wheelers such as Autos have also performed well, as seen by the sales growth of the largest tractor maker in India, i.e., M&M, which reported an increase of ~70% in sales volume YoY and ~35% MoM but other manufacturers such as Escorts had increased their wholesale numbers by only ~22% YoY. The Indian industry has fared significantly well in FY21, with the highest growth in the past five years.

The demand in this segment is much more complex than any other vehicle segment as the government policies have a much significant influence. First is the credit availability for these tractor owners, as almost 3/4th of the total purchases of the tractor are on credit. The MSP set by the government drives the farm incomes, which eventually translates to higher sales volumes. Since agriculture is included in the priority sector lending, we have seen several rate cuts in FY21, which can be a metric behind the increasing sales. Several other government regulations are also connected to these sales volumes. Going forward, as we see an increase in agricultural health, tractor volumes can be expected to see a further uptick.

Another important metric in the tractor's demand is the replacement cycle. Since the tractors are replaced in ~8 years, the demand for FY22 would also depend on the sales performance in ~FY15-16, where we witnessed a contraction in sales volumes. So, the sales due to replacement demand might see slower growth in FY22.

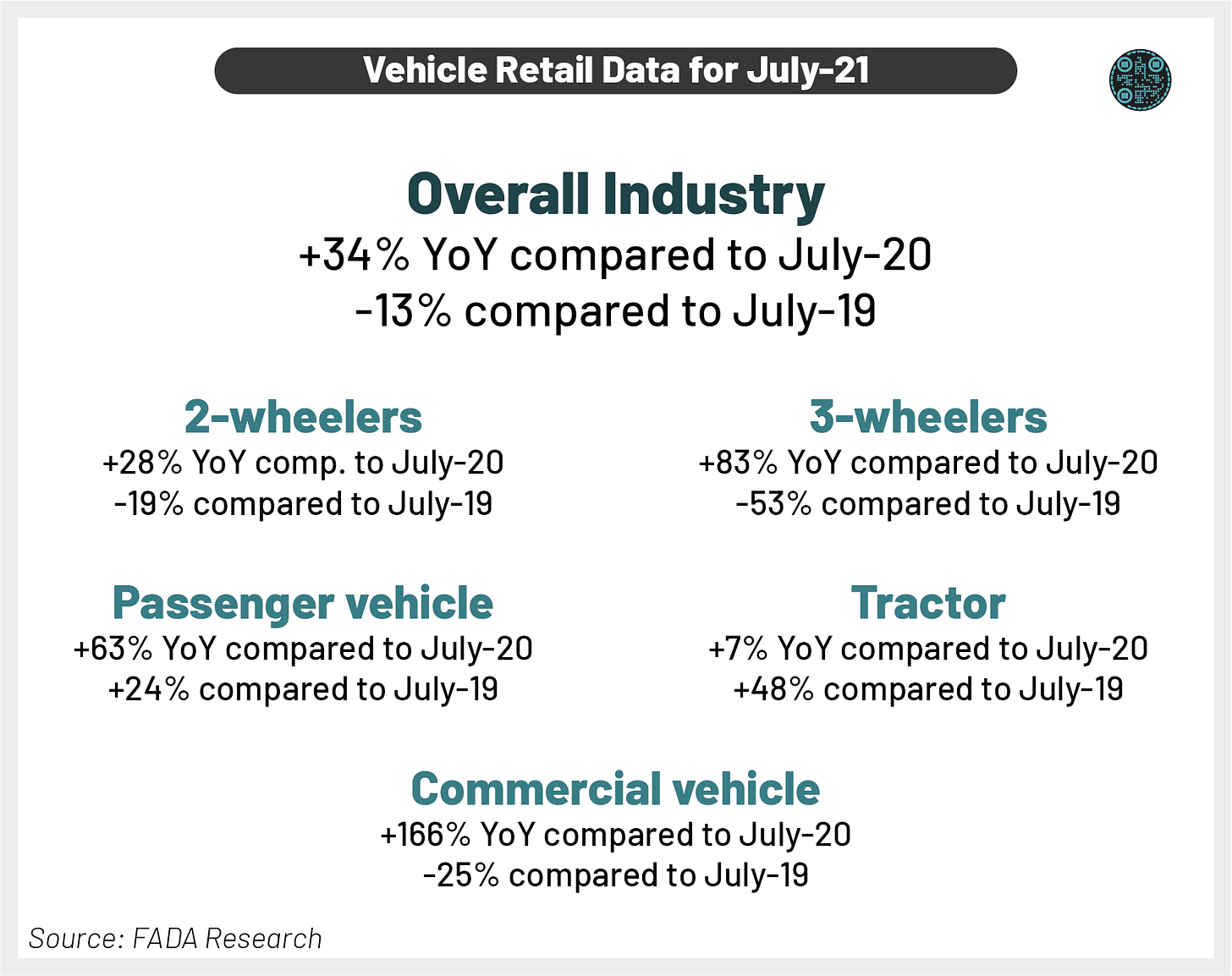

So these were the numbers reported by the manufacturers, which doesn't accurately represent what's going at the dealership level. Now let's look at the actual bottom-line data, i.e., retail sales. FADA released the status of retail registrations, which signified that there had been a pickup compared to last year (Covid year). Still, the auto industry looked a little damped by registering a negative growth compared to the Non-Covid year, i.e., July-19.

Lastly, let's look at how some of the Indian listed players have done with respect to their stock price levels on a YTD basis.

So this was our view regarding the Auto sector health, the discussion can go on and on from here, but we think this briefs up the current demand scenario.

Disclaimer: The content published is only for educational purposes and not any kind of investment advice..

Author(s): Akshit Agrawal

We hope you liked this article, see you again sometime soon. Until then, you can share this post with others who might enjoy reading this..

Wonderful insights.

Great piece