First GDP Advance Estimates was released…📈

Economists worldwide are busy throughout the year estimating various fundamentals and sharing their opinions with individuals like us. The National Statistics Office (NSO) in India is busy nowadays estimating the GDP and providing forecasts to us by the same, which would pave the way forward and reflect the growth story that India has achieved while sailing through the pandemic.

The First GDP Advance Estimates published by the NSO on 7th January 2022 considers all kinds of indicators to come to a consensus while interpolating the Benchmark Indicators using past data. This exercise was actually introduced in FY17 and has been almost consistent in estimating the GDP and performance of various industries with the economy's actual performance.

The estimation is not an easy one and uses inputs from various high-frequency indicators available in India to estimate sector-wise performance forecasts. This particular report used:

Index of Industrial Production (IIP) of first 7 months of the financial year,

Financial performance of Listed Companies in the Private Corporate sector available upto quarter ending September, 2021

1st Advance Estimates of Crop production,

Accounts of Central & State Governments,

Bank Deposits & Credits,

Net Tonne Kilometres and Passenger Kilometres for Railways,

Passengers and Cargo handled by Civil Aviation,

Cargo handled at Major Sea Ports,

Sales of Commercial Vehicles, etc., available for the first 8 months of the financial year.

...and many other data points from various agencies.

Talking about the estimates, India is poised to grow at 9.2% in FY22 in real terms after contracting by 7.3% in FY21. That means the Real GDP has actually grown if compared to the pre-pandemic year (FY20) by 1.26%. Real GDP, which is estimated at ₹147.5T, is a result of growth shown by almost every sector in the growth accounting equation led by Mining and Quarrying (growing at 14.3%) followed by manufacturing operations (growing at 12.5%). In Nominal terms, estimates suggest that GDP would grow at 17.6% YoY in FY22 to ₹232.14T after contracting by 3% in FY21. The growth over the pre-pandemic year, i.e., FY20, is estimated at 14.07%.

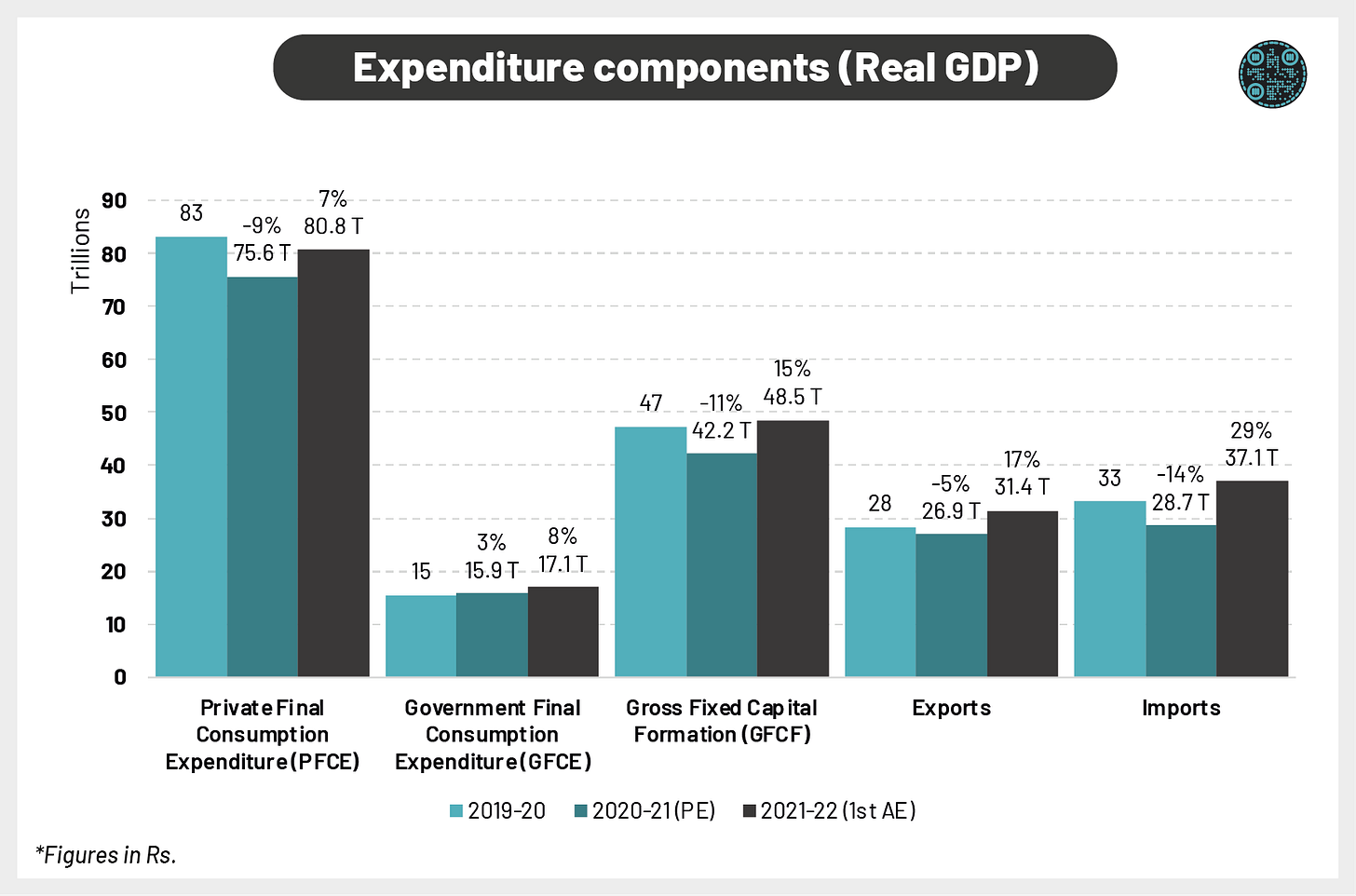

Looking at the expenditure components, Private Consumption has been lacking since the pandemic, and it's still 2.9% below the FY20 levels, which means that other components lead the growth in real terms. However, the private consumption is up by 6.8% over the last year (FY21) at ₹80.8T in real terms comprising ~55% of the GDP as per the 1st Advance Estimates in FY22.

The variable that has been able to balance the de-growth in Private Consumption has clearly been the Investment cycle led by the government, as seen from the 15% YoY (vs. 2.6% growth compared to FY20) growth in Gross Fixed Capital Formation (GFCF). Various analysts have highlighted their concern with over-optimistic growth in GFCF as the private sector CAPEX is still weak, and a significant share of CAPEX is pushed by the Centre's infra push as well as state's spending on healthcare and welfare schemes than on new or brownfield infrastructure schemes. On the other hand, the finance ministry is confident that the Centre's thrust on Capex will crowd in private investment.

Exports and Imports have both gone up as per the estimations, and clearly, there's some sign of worries as the Imports have gone up substantially at ₹37.1T (up by 29% YoY) while the exports have gone up by only 17% YoY at ₹31.4T.

Lastly, there has been some sign of improvement in the Per Capita Income side as well, which shows a growth of 16.7% YoY in nominal terms (+8.4% in real terms), over and above the pre-pandemic levels of ₹1,34,186 in FY20 (at current prices).

There have already been some disagreements with the growth projections highlighted by various economists. One such example...

So yeah... this was all that was highlighted in the 1st AE released by the NSO and is subject to revisions as we would have two more releases from the department, i.e., on 31.01.2022 (1st Revised Estimates) and 28.02.2022 (2nd AE).

Inflation is heating the economy again🚀

Taking about the estimates, NSO also released the inflation data for the month of December 2021, and it's not something that's keeping the people at the RBI at ease. Inflation rose to 5.59% in Dec-21 because of higher food inflation (4.05%) and Clothing (7.94%). Other categories such as Housing, Fuel & Light, and Miscellaneous, moderated last month. Oil and fats led the pact in the food and beverage category as the prices rose by 24.32% YoY in Dec-21. Even for the government, this has been a serious concern, as it also reduced import tariffs to ease the situation. CPI Inflation has already breached the RBI's upper threshold of 6% in May and June 2021 and is again on the rise, which could fuel the fire in the already heated economy with the low interest rates. Some analysts believe that the recent restrictions in the country might delay the RBI's action of reducing excess liquidity from the system and its proposed plan on increasing the interest rates.

One of the tools used by the central bank in India, a.k.a the RBI, is Variable Reverse Repo Rate (VRRR), and owing to the recent uncertainty, it took the bond markets by surprise when the auctions expressed under the VRRR route fell short of the guidelines. The RBI had earlier expressed to suck out excess liquidity to the tune of ~8 trillion but had declared a 14-day auction after the market hours for only ~5 trillion for the particular week ending on 14th January 2022. The 14-day auction amount and the absence of 3-day VRRR auction communication cheered the bond markets.

The IIP data released by the NSO highlighted a YoY growth of a mere 1.4% in Nov-21 (vs. -1.6% in Nov-20) against a growth of 3.2% a month ago in Oct-21. It is one of the slowest growth months in CY21 and the lowest since Mar-21. However, the April-November 2021 period highlights strong growth led by previous months at 17.4% (vs. -15.3% same period last year). The slow growth is attributed to the heavy-weighted Manufacturing sector, which grew at 0.9% in Nov-21 against a growth of 2% in the previous month. The weak period is also highlighted by negative growth in the manufacture of Capital goods and Consumer durables in Nov-21. The trending signals could be attributed to the recent surge and restrictions across the country and maybe a cause of concern. The RBI's stance against the erosion of liquidity might also act as an aid to the sector.

RBI's next MPC meeting would set the course of the situation, and yeah, we shall wait for those revised estimates from the government.

Disclaimer: The content published is only for educational purposes and not any kind of investment advice..

Author(s): Akshit Agrawal

We hope you liked this article, see you again sometime soon. Until then, you can share this post with others who might enjoy reading this..

Very helpful and informative.