Crude hit an All-Time high this month, and economies worldwide started strategizing according to their geopolitical relations with Oil producing countries.

So Russia invaded Ukraine..

The Impact of Russia's invasion of Ukraine was not unexpected as the third-largest oil-producing country has been incentivizing countries to buy its Oil at a steep discount. It offered India a heavy discount of $25-30/ barrel. But importing cheap Oil from a country that contributes to <1% of the total Crude imports would not solve the problem of India's piling Current Account Deficit.

Russia produces ~11 million barrels per day, of which 50% of the production is used for domestic consumption. The sanctions put on Russia by the world's superpowers have brought the economy to a standstill. It is the second-largest crude oil exporter and the largest oil products supplier (Crude Oil and other Oil products) to global markets, which means a significant chunk of the countries' paycheck comes from supplying Oil to other countries, and the impact of sanctions has put a major dent and spiked the Crude Oil prices in the International markets.

India is heavily energy import dependent..

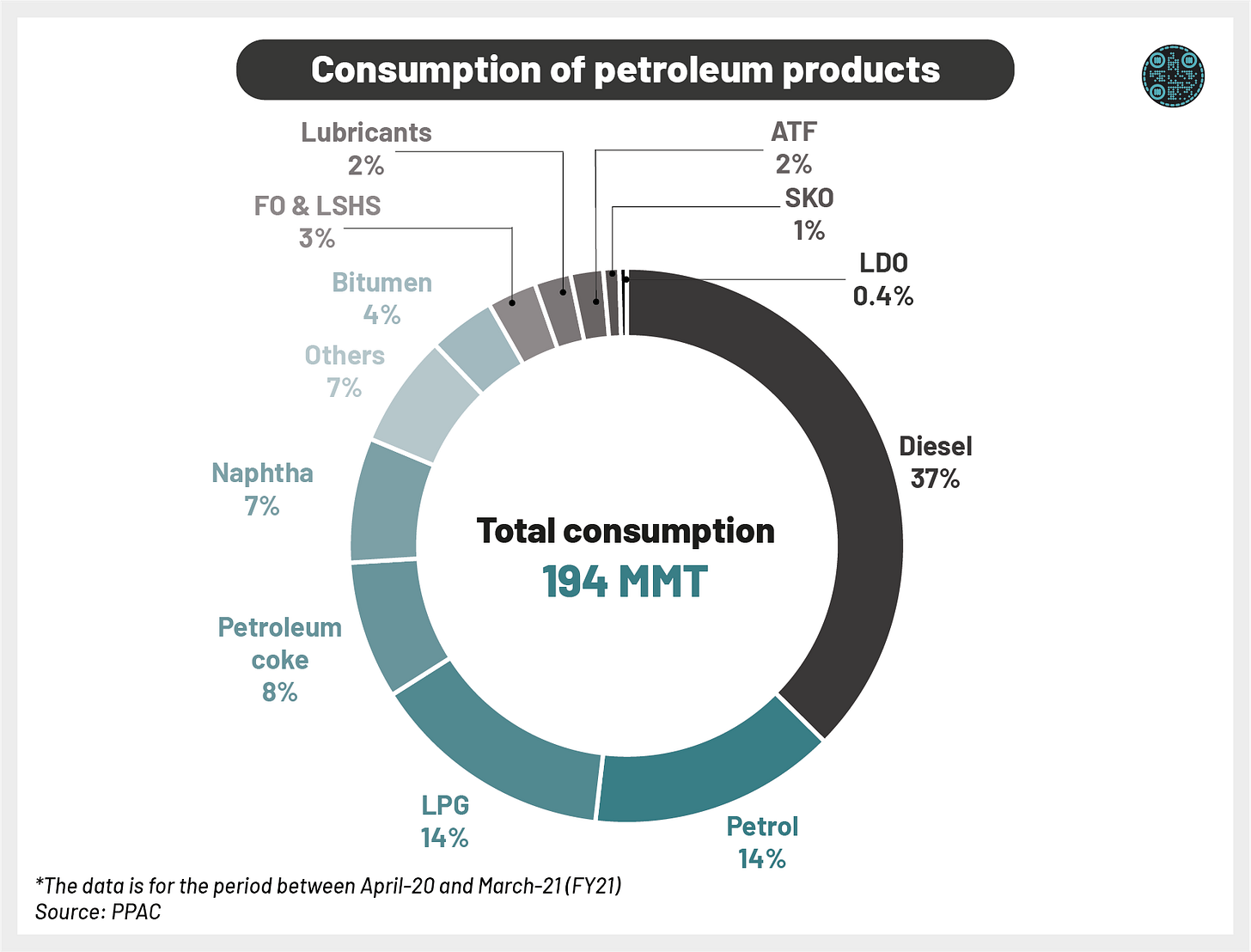

Looking into India's relationship with Crude tells us a really saddening story. India had an import bill of ~$62 billion in FY21, which was down ~39% YoY as the demand in the economy fell due to the pandemic. According to a report by BP, India's primary energy demand fell by 5.9% in 2020 due to the lockdowns in the country, while it has grown by a ~4.7% average rate in the last ten years. Also, Oil consumption fell significantly by ~10% over the said period (vs. average 10-year growth of 4.5%). India has been a net exporter of Crude Oil products, with FY21 exports at ~$21 bn. with its ~222 MMT of processed Crude Oil by Indian refineries.

As a major use of the Crude is to run the vehicles, it would be naive to say that the rising crude prices won't hit the consumers so much. Inflation in India stood above the RBI's target for the second consecutive month in Feb '22 at 6.07%, with fuel inflation at 8.73%. The impact of the rising Crude would eventually be passed onto the consumers with hikes in fuel prices. As the prices were artificially kept stagnant during the past few weeks, the inevitable price rise may pinch the CPI Index as we advance. Many experts have highlighted that this rise could pose a threat to the inflation figures for FY23.

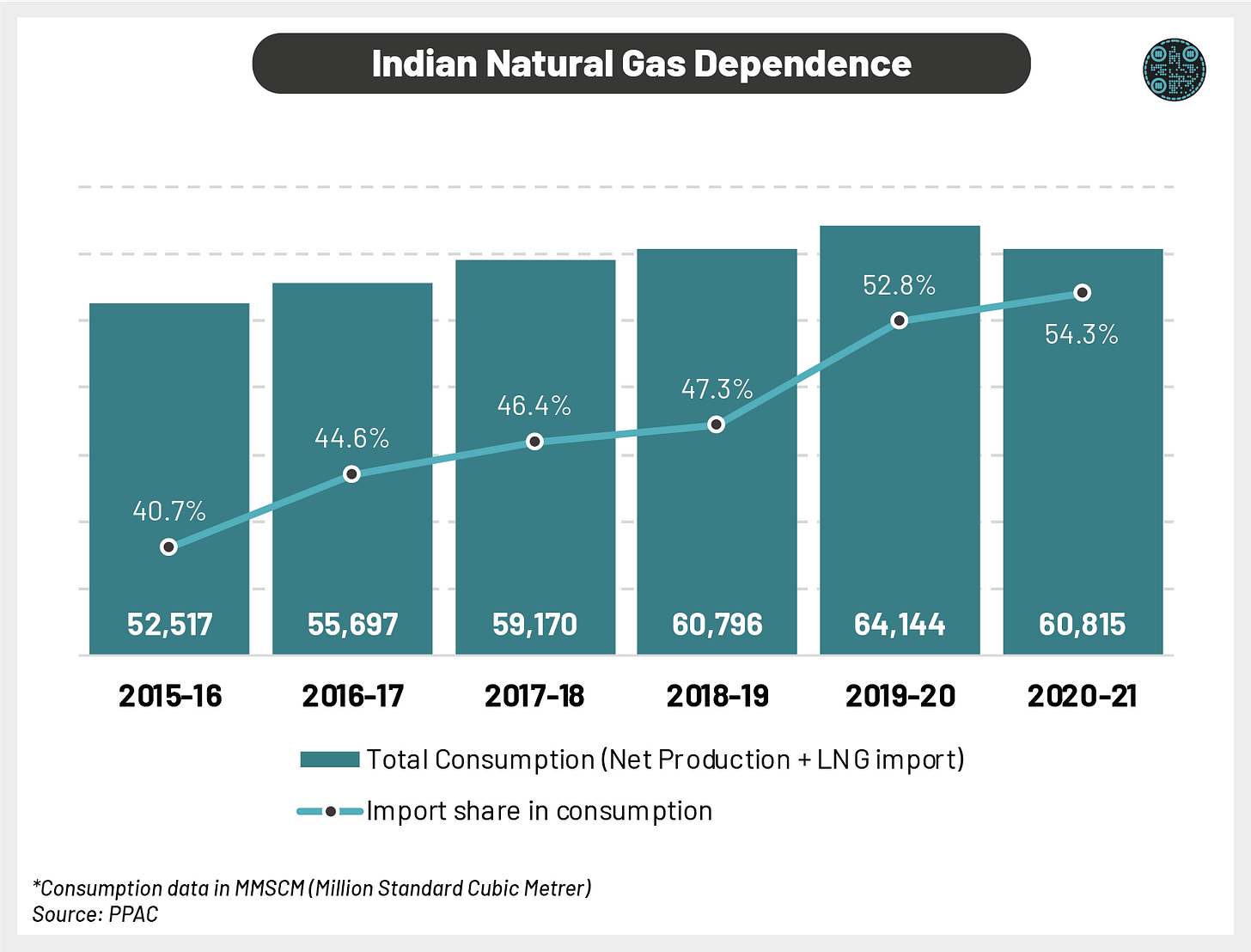

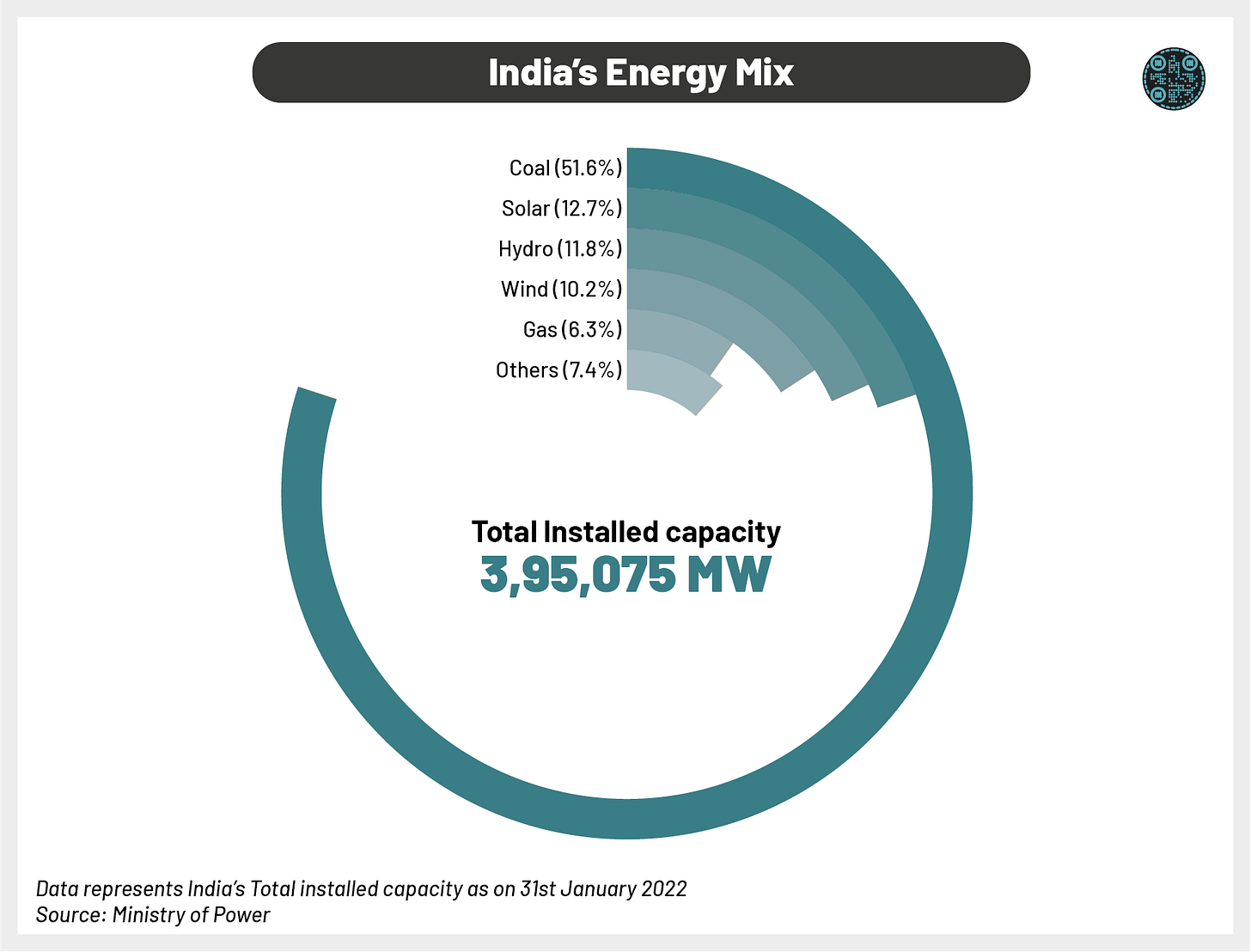

Talking about Natural Gas, a significant energy source contributes ~6.3% of India's power generation capacity and is a cleaner fuel than coal for power generation. The impact of the war has put some countries in a vulnerable state, and the dependency is severe. POI: Russia accounts for ~40% of the total natural gas imports in the EU. The escalation led to the Natural Gas prices rising by as high as 140% and above in UK and EU as they are heavily dependent on Russian gas. Coming to the home country, India imported ~54% of its total Natural Gas demand in FY21 (vs. ~41% in FY16). Domestic production has remained stagnant for a while and has been falling YoY, with the production levels at ~21 MMT (FY21). To reduce this dependency, India should boost domestic production, atleast at a rate higher than the demand growth of 3% (CAGR growth rate between FY16 and FY21).

Shift towards renewables is not easy..

But India cannot immediately ramp up its production of Natural Gas as there are heavy capital investments required to set up gas-fired power plants. Also, India's commitment to the Paris agreement to lower its greenhouse gas (GHG) emissions intensity needs urgent action for which it needs to quit burning coal. The focus towards renewables must include Natural Gas as an immediate source, as it is a significantly cleaner power source. Gas power infrastructure, if built, must stay around for decades as it includes long-term contracts and the pipeline lifespan is approximately 40 years, which means Natural Gas would still contribute to a significant share of the power source during India's renewable phase. Although India has already announced to increase the share of Natural Gas in the energy mix to 15% by 2030 as a "transition fuel."

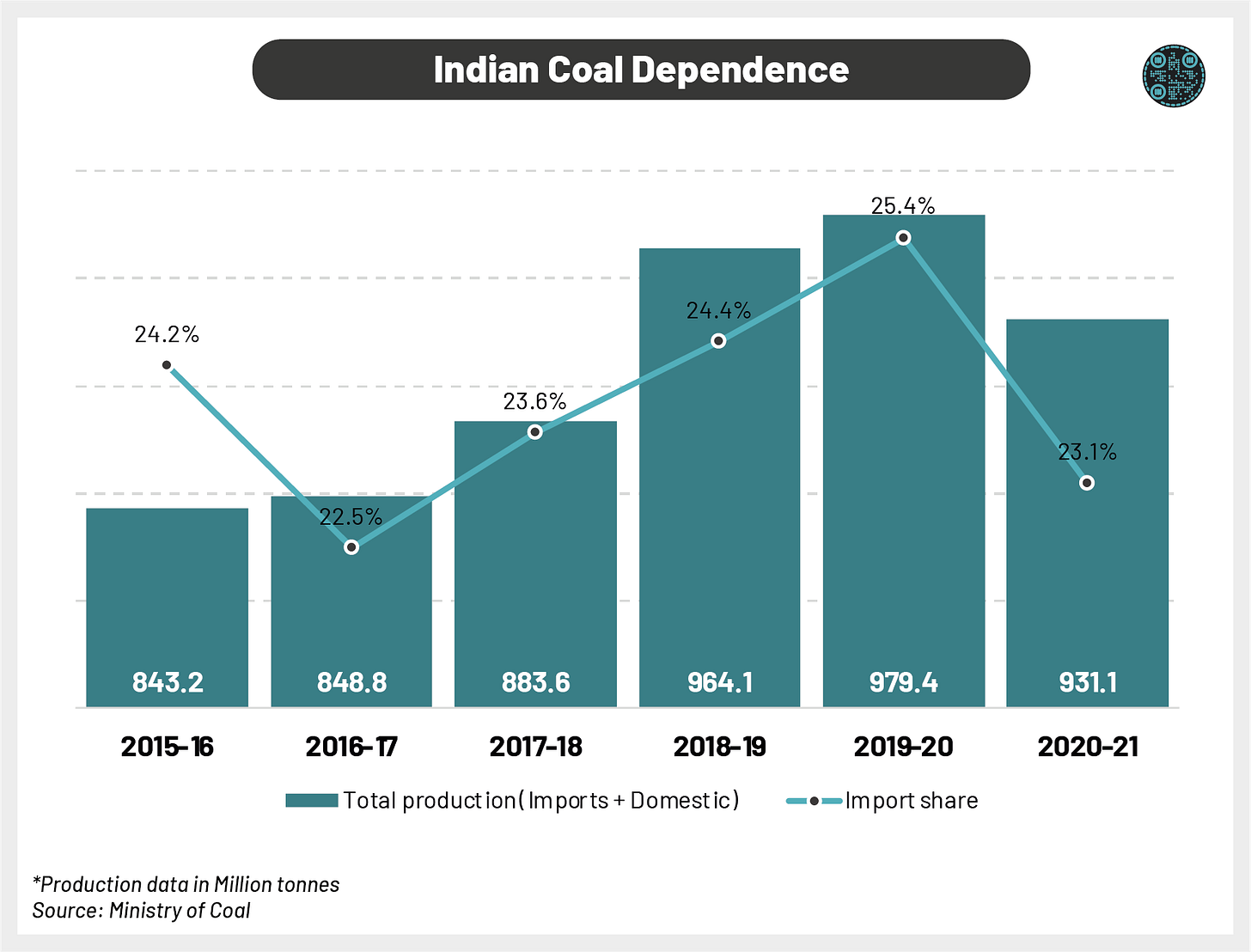

Coal, the largest energy source for India, has also shown similar trends. The import dependency has increased over the years, with the FY21 import bill at ~₹1.2 trillion, representing an import share of ~23%. Although the imports fell in FY21 due to lower demand, the dependency over the years increased from the 5-year lows of ~22.5%. Coal is a major energy source used in power generation, steel & cement manufacturing, etc. Hence, any fluctuation in prices may disrupt the margins of other interconnected industries. Russia exports almost 50% of its total coal production to other countries, with OECD Europe, Asia and Oceania comprising ~85% of the total exports of Russia.

As of 31st January 2022, India had an installed capacity for power generation of ~395 GW with a significant share from coal-fired plants. With the share of fossil fuels in power generation at ~60%, India's dependency on imports from other countries should decline to promote healthy economic growth. While the share of coal in India's power generation is at ~52%, the U.S. (in 2020) generated only 19% of its power through this energy source. Renewables (wind, solar, hydro, etc.) represent a better picture in India, with its share at ~37% of the total installed capacity. India as a country should adopt renewables with an emergent effect to reduce its carbon emissions and improve its current account.

Ride forward..

A look towards India's existing energy mix shows that India is still Coal dependent, and the ride towards renewables is far on the horizon. The power demand rose by ~4% CAGR over the last ten years, and it is only going to grow in the future, but in a country with a consistent power deficit, new energy sources must include cleaner fuels. The share of the Private sector in the energy mix is still ~49%, which must increase for an urgent transition. A few policy missteps increased the energy dependence to 87% in FY21 from 82% in FY12 and to 54% for Natural Gas in FY21 from 28% in FY12. According to the BP report for Energy Outlook 2019, the import dependence on Oil could increase to 95% and to 60% for Natural Gas. The country's energy sources are vulnerable to international events, and it must implement a strong import diversification strategy to meet its vision.

Disclaimer: The content published is only for educational purposes and not any kind of investment advice..

Author(s): Akshit Agrawal

We hope you liked this article, see you again sometime soon. Until then, you can share this post with others who might enjoy reading about this topic, and Join us on Twitter to see what’s cooking behind the curious mind..