As the man above himself said, "When there are multiple solutions to a problem, choose the simplest one."

Something interesting happened in August 2019 in the U.S. capital markets when the AUM (Assets Under Management) of the Passive Funds crossed the AUM of Active Funds for the first time, leading to a share of 50.1% in the former (Passive funds) with the rest in the latter. This was not an unprecedented event, but a series of outflows in the Active funds over the past years with continuous inflows into the Passive funds.

A quick and layman explanation of the terminology:

Active funds are the funds that operate to generate extra returns compared to a benchmark based on the investment philosophy in return for a fee (proportioned to the investment and assets), for example, Axis Bluechip Fund, while on the other hand,

Passive funds are born to replicate the benchmark's performance, say NIFTY 50, simply because one cannot easily invest in all the benchmark constituents by himself. An example could be an ETF, such as Nifty BeES or any other Index fund.

In India, the passive industry share also increased significantly; from a mere ~16% in 2019, it has grown to almost a quarter of Equity AUM. The Indian passive funds industry is dominated by ETFs, which account for ~9% of the AUM of the mutual fund industry (up from ~4% in 2019).

Not only the statistics, but some of the prestigious fund managers also agree with the reality. Nippon Life India Asset Management Ltd., which brought the first Index ETF to India in 2001, had 1 million clients in March 2020, which had grown at an exceptional rate to 2.3 million by the end of Fiscal 2021. Here's what the head of ETFs said during an interview.

What had taken 19 years between 2001 and 2020, we did in just the last one year.

So, why have people stopped chasing the "alpha" and are shifting towards these schemes?

Firstly, as per the S&P Global report, less than 27% of the actively managed large-cap funds in India have outperformed the Index (S&P BSE 100) on an absolute return basis (vs. 20% on a risk-adjusted basis), measured over a 3-year period ending June 2020. While active funds in the Mid/ Small cap have generated some "alpha," the Index has been the clear winner in the large-cap. Secondly and the most controversial reason is the higher fees charged by these fund houses, which can be ~2% of the assets compared to just ~.5% for the passive funds, a significant difference of ~150 bps. The shifting trend might be due to several other reasons, such as regulations imposed by the SEBI on the mutual funds, but you get the gist.

Can we apply the insights into our own investment philosophy? The straight answer is both Yes and No as no two portfolios are the same and no two investors have the same risk appetite. Any risk-averse investor would naturally stay away from the equity markets as a whole. So what is the way out?

Asset Allocation and persistence

Passive funds allow investors to get immediate exposure to the asset class with pre-defined weights based on efficient formulas and are broadly diversified. According to some researches, Asset Allocation has been proved to be the dominant factor in portfolio return variability while, on the other hand, market timing and security selection only having a minor influence, expressly in the long-term.

It takes a lot of energy to generate that extra return over the Index that the investor forgets about the portfolio turnover. Over the long-term, costs associated with portfolio turnover nets the return to below the Index's performance. Still, extra is extra, and nobody wants to give up on the opportunity of making some extra bucks on their investments, so let's sum it up.

Core-Satellite approach to investing

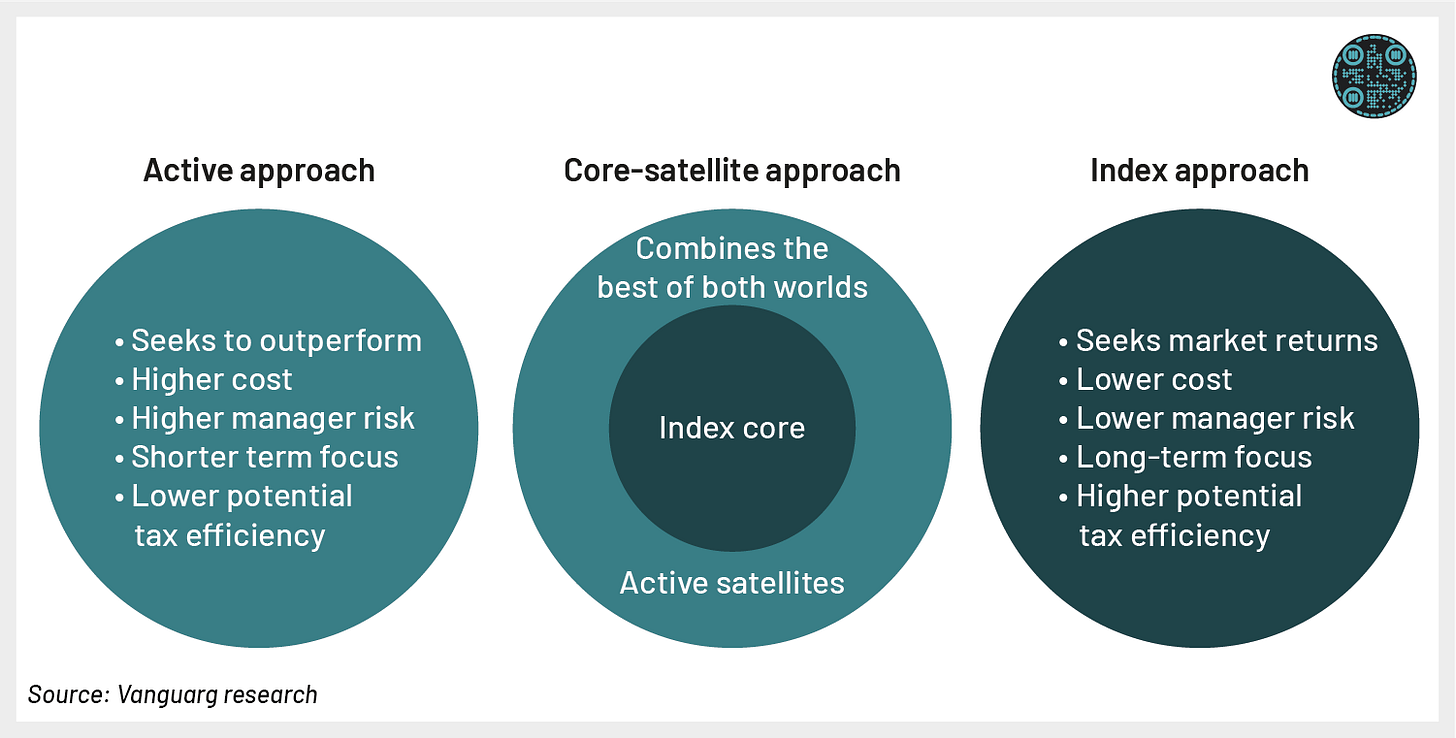

The approach to investing which combines the best of both worlds- the active approach as well as the passive approach. Like the name, it has an Indexed core with an active satellite revolving around it. Combining portfolio theory with the real-world market-tested approach provides superior long-term performance to a portfolio while maximizing rewards per unit of risk.

Core portfolio tracks the market performance at a significantly lower cost (lower management fees). The Index such as Nifty 50 (CNX NIFTY) comprises a broad spread of securities that provides diversification benefits. The fund tracking the same Index doesn't require active selection of securities, thereby lowering active management fees. Since the Index funds have lower portfolio turnover (because they track the constituents of Index), it reduces the tax liability on the investor's front too. Hence, the benefits of lower costs, lower volatility, broader diversification, etc., provides attractiveness and the opportunity for outperformance. One additional benefit over the active fund is the lower dependence on the fund manager, or generally knows as the "Key person risk," hence reducing the uncertainty.

On the other side, the Active Satellite seeks additional benefits of market inefficiencies and generates the "alpha" for the overall portfolio. As presented above, there are fewer funds in the large-cap which have outperformed the Index in the past. However, still, some funds in the Mid/ Small-cap have outperformed their benchmarks by a significant margin, thereby highlighting the presence of "alpha" in the said segments. With the recent growth of DIY investors in India, the active portfolio can serve them as their beta portfolio, which can be used to test their skills while also preventing capital erosion through the core portfolio.

The discussed approach can be summarized through the below infographic taken from one of the researches of the most "passive driven companies," Vanguard, Inc.

Conclusion

As highlighted, active outperformance has not been easy for everyone in the past, nor will it be a piece of cake in the future. The most essential thing in the investment field is capital retention, and the core-satellite approach can be a potential way of attaining the objective.

Who dat in the image above?

John Clifton Bogle was the founder of The Vanguard Group. He created the idea of passive investing with the objective of making it easy for the average investor to invest at a low cost with its first-ever Index fund, the Vanguard 500.

Disclaimer: The content published is only for educational purposes and not any kind of investment advice..

Author(s): Akshit Agrawal

We hope you liked this article, see you again sometime soon. Until then, you can share this post with other who might enjoy reading this..

Really insightful

Great Article